As a provider, medical billing involves understanding the roles of core entities such as physicians, practices, and insurers. It requires proper coding and submitting claims electronically through clearinghouses. Outsourcing billing services to vendors can simplify the process. Additionally, ensuring accurate patient demographics and understanding payer policies are crucial for successful billing.

Physicians and Healthcare Professionals: The Cornerstones of Medical Billing

In the intricate world of medical billing, physicians and healthcare professionals play pivotal roles that ensure the seamless flow of medical services and reimbursements. As the providers of medical care, their responsibilities extend beyond patient consultations and treatments to encompass the intricacies of billing for services provided.

Physicians are tasked with meticulously documenting the procedures, diagnoses, and treatments rendered to their patients. This documentation serves as the foundation for accurate medical billing, ensuring that insurers and other payers are provided with the necessary information to process claims. They also play a crucial role in reviewing and submitting claims, ensuring that they are complete, accurate, and compliant with ever-changing industry regulations.

Healthcare professionals, such as nurses, medical assistants, and technicians, also contribute significantly to the medical billing process. They assist physicians in accurately capturing patient demographics, insurance information, and other relevant data. Their attention to detail and knowledge of coding practices help to prevent errors and ensure timely and accurate reimbursements.

By diligently fulfilling their billing responsibilities, physicians and healthcare professionals contribute to the financial stability of their practices while ensuring that patients receive the medical care they need without facing unexpected expenses.

Practices and clinics: Discuss their responsibilities in medical billing, such as coding and submitting claims, and the different types of practices and their billing processes.

Practices and Clinics: The Cornerstones of Medical Billing

The world of medical billing revolves around the core entities of physicians, practices, and hospitals. As we delve into the responsibilities of practices and clinics, we’ll uncover the intricacies of medical billing beyond the walls of healthcare institutions.

Coding and Claim Submission: The Foundation of Billing

Practices and clinics play a crucial role in medical billing by *coding the services provided to patients. This process involves meticulously translating medical procedures and diagnoses into specific codes that insurance companies use to determine reimbursement amounts.

Once the services are coded, the clinic’s team prepares and submits claims to insurance payers. These claims contain detailed information about the services provided, the patient’s demographics, and other relevant data that allow insurers to process the request for payment.

Understanding the Diverse Practices

The landscape of medical practices and clinics is vast, each with its unique billing processes and challenges. Private physician’s offices handle the billing for their patients directly, while group practices have a centralized billing department that oversees the billing for multiple providers.

Hospitals, on the other hand, have complex billing systems that involve multiple departments, including inpatient and outpatient billing, emergency room billing, and ancillary services billing. Electronic health records (EHRs) play a critical role in streamlining billing processes in hospitals and clinics by providing easy access to patient information and automating certain billing tasks.

Navigating the Billing Process

Practices and clinics must navigate a myriad of billing regulations and guidelines. They are responsible for ensuring that claims are submitted accurately and timely to maximize reimbursement. The billing process often involves handling claim denials, following up on payments, and providing necessary documentation to support claims.

Some practices and clinics choose to outsource their billing operations to billing vendors. These vendors provide specialized services to manage the billing cycle, allowing practices to focus on patient care. However, it’s essential for practices to carefully evaluate the performance and reliability of any billing vendor they consider working with.

Hospitals and Health Systems: Navigating the Complexities of Medical Billing

Hospitals and health systems, the cornerstones of modern healthcare, play a pivotal role in medical billing. These sprawling entities navigate a labyrinth of billing processes, each department contributing to the seamless flow of revenue.

Roles of Key Departments

Billing Departments: The unsung heroes of medical billing, these departments bear the responsibility of preparing and submitting claims, handling denials, and meticulously following up on payments. Their accuracy and efficiency directly impact the financial health of the hospital.

Coding Specialists: These experts assign standardized codes to medical procedures, ensuring proper reimbursement. Their precision is crucial for capturing all services rendered and maximizing revenue.

Patient Access Services: The first point of contact for patients, these departments collect demographic information, process co-pays, and facilitate scheduling. Their efficiency sets the tone for a positive patient experience and timely billing.

The Power of Electronic Health Records (EHRs)

EHRs have revolutionized medical billing in hospitals and health systems. These digital repositories centralize patient health information, enabling seamless documentation and billing. By eliminating бумажная работа, EHRs streamline processes, expedite claims submission, and reduce the risk of errors.

Hospitals and health systems are faced with the challenge of managing complex patient populations, from insured to uninsured and underinsured individuals. They must navigate a myriad of insurance plans, each with its own set of rules and regulations. The complexity of these billing processes requires a sophisticated and highly trained team of professionals dedicated to ensuring accuracy and compliance.

To optimize billing operations, hospitals and health systems often outsource certain tasks to third-party billing vendors. These vendors provide expertise in claims processing, denial management, and revenue cycle management, allowing hospitals to focus on patient care while maximizing reimbursements.

By understanding the intricacies of hospital and health system billing processes, stakeholders can streamline operations, improve efficiency, and positively impact the financial health of these vital institutions.

The Nerve Center of Medical Billing: Unraveling the Functions of Billing Departments

Introduction:

Billing departments stand as the central hubs of medical billing operations, playing a pivotal role in revenue generation and ensuring smooth financial transactions between healthcare providers and insurance companies. Their responsibilities extend to a wide spectrum of tasks, from meticulously preparing and submitting claims to efficiently handling denials and diligently following up on payments.

Preparing and Submitting Claims:

The primary function of a billing department is to prepare and submit claims to insurance companies. This involves carefully coding procedures and diagnoses in accordance with established medical billing guidelines. Billing professionals must possess a thorough understanding of both medical terminology and coding systems to ensure accuracy and compliance. Once claims are prepared, it’s crucial to transmit them promptly and efficiently to the appropriate insurers, ensuring they are processed timely.

Handling Denials:

Inevitably, not all claims sail through the billing process seamlessly. Billing departments must be adept at handling denials, which can stem from various reasons such as incorrect coding, missing documentation, or coverage limitations. Dealing with denials requires a blend of analytical skills, negotiation abilities, and persistence. Thoroughly reviewing denials to identify the root cause can help prevent similar errors in the future.

Following Up on Payments:

After claims have been submitted, billing departments assume the responsibility of tracking their progress and following up on payments. This involves monitoring the reimbursement process, contacting insurers for updates, and addressing any payment delays or discrepancies. Timely follow-up can significantly improve cash flow and reduce accounts receivable.

Additional Responsibilities:

Beyond these core functions, billing departments may also handle a range of additional tasks, including:

- Charge entry: Entering patient charges into the billing system

- Patient billing: Sending statements to patients and processing co-pays and deductibles

- Payment posting: Recording and applying payments to patient accounts

- Collections: Pursuing unpaid patient balances

- Reporting: Generating various financial reports for internal and external use

Conclusion:

The functions of a billing department are complex and multifaceted, requiring a skilled and dedicated team that is well-versed in medical terminology, coding systems, and billing regulations. Their efforts ensure that healthcare providers receive fair and timely reimbursement for the services they provide, ultimately facilitating the delivery of quality patient care.

Billing Vendors: Powering Healthcare with Outsourced Medical Billing

Introduction:

Medical billing is a crucial aspect of healthcare that ensures timely and accurate payments. Billing vendors, also known as revenue cycle management (RCM) providers, play a vital role by outsourcing various aspects of this complex process, empowering providers to focus on patient care.

Types of Services Offered:

Billing vendors offer a comprehensive suite of services to streamline the revenue cycle:

- Patient registration and insurance verification: Ensures accurate patient information and eligibility for services.

- Coding and claims submission: Translates medical records into standardized codes and prepares claims for submission to insurers.

- Claims follow-up and tracking: Monitors claims status, identifies denials, and follows up for resolution.

- Payment posting and reconciliation: Records payments, reconciles accounts, and handles patient balances.

Benefits of Outsourcing to Billing Vendors:

Outsourcing medical billing to vendors offers numerous benefits to healthcare providers:

- Cost savings: Vendors leverage economies of scale and specialized technology to reduce operational costs.

- Increased revenue: Expert billing teams maximize reimbursement by optimizing coding and identifying missed charges.

- Improved efficiency: Automating tasks and streamlining processes enhance productivity, allowing providers to focus on patient care.

- Compliance and accuracy: Vendors stay updated on regulations, ensuring compliance and minimizing billing errors.

- Scalability: Vendors can handle fluctuations in patient volume, supporting providers during peak periods and growth phases.

Choosing the Right Billing Vendor:

When selecting a billing vendor, due diligence is crucial. Consider factors such as:

- Experience and expertise: Look for vendors with a proven track record in medical billing and familiarity with industry regulations.

- Technology platform: Ensure the vendor’s system aligns with your practice’s needs, including electronic health record integration.

- Customer support: Choose vendors with responsive and reliable support teams to address concerns promptly.

Conclusion:

Billing vendors play a pivotal role in empowering healthcare providers by providing outsourced medical billing services. By streamlining processes, increasing revenue, and ensuring compliance, they help providers focus on delivering exceptional patient care. By carefully selecting a billing vendor that meets their unique needs, healthcare practices can unlock the full benefits of outsourcing and optimize their revenue cycle.

Clearinghouses: The Unsung Heroes of Medical Billing

In the complex world of medical billing, clearinghouses play a vital role as the intermediaries between healthcare providers and insurance payers. They act as a bridge, electronically transmitting claims and facilitating the payment process.

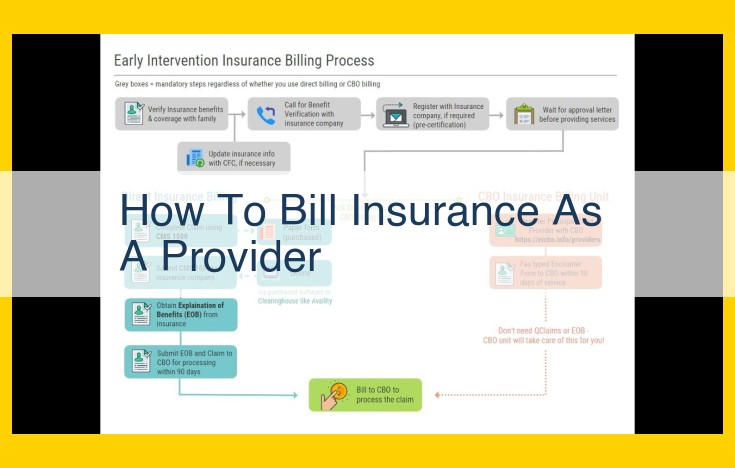

Imagine a scenario where a doctor’s office wants to submit a claim to an insurance company. Instead of sending the claim directly, it is routed through a clearinghouse. The clearinghouse then translates the claim into a standard format that the insurance company can easily understand. This saves time and reduces the risk of errors that could result in denied claims.

Furthermore, clearinghouses handle the remittance advice, which is the electronic response from the insurance company indicating whether the claim was approved, denied, or requires further review. They consolidate this information and deliver it to the provider in a clear and concise format, making it easier for the provider to track the status of their claims and payments.

Benefits of Using Clearinghouses:

- Streamlined claims submission: Electronic claims submission through clearinghouses reduces the time it takes to submit and process claims.

- Reduced errors: Clearinghouses perform automated checks to identify and correct errors in claims, increasing the likelihood of approval.

- Faster payment: By facilitating the electronic exchange of remittance advice, clearinghouses enable providers to receive payments more quickly.

- Enhanced compliance: Clearinghouses help providers ensure compliance with industry regulations and coding standards, minimizing the risk of audits and penalties.

- Improved efficiency: By outsourcing the claims submission process, providers can focus on providing patient care and reduce their administrative burden.

In conclusion, clearinghouses are indispensable partners in the medical billing process, ensuring smoother communication between providers and payers. Their electronic capabilities, error-checking protocols, and ability to streamline payment processing allow healthcare providers to operate more efficiently and deliver better patient care.

Medicare: Navigating Medical Billing for Seniors and Individuals with Disabilities

Introduction:

Medicare, the federal health insurance program designed for seniors (age 65 or older) and individuals with disabilities, plays a crucial role in the medical billing landscape. Its intricate billing requirements and regulations can be a daunting maze to navigate. Understanding the nuances of Medicare billing is essential for providers, patients, and anyone involved in the medical billing process.

1. Understanding Medicare Insurance:

Medicare consists of four parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage). Each part covers different aspects of healthcare services.

2. Billing Requirements:

Providers must adhere to specific billing requirements when submitting claims to Medicare. This includes:

– Using the correct Medicare billing codes (Healthcare Common Procedure Coding System, or HCPCS)

– Providing detailed patient information

– Documenting medical necessity and appropriate services rendered

3. Regulations and Compliance:

Medicare strictly enforces regulations to ensure the integrity of its billing system. Providers must comply with these regulations, including:

– Anti-Fraud and Abuse Laws: Prohibiting false or misleading claims

– Stark Law: Restricting physician referrals to services they invest in

– Bundled Payment Programs: Requiring providers to accept a bundled payment for certain procedures

4. Patient Involvement:

Patients play a significant role in Medicare billing. They are responsible for providing accurate demographic information, paying co-pays and deductibles, and understanding their insurance coverage.

5. Role of Medicare Administrative Contractors (MACs):

MACs are contracted by Medicare to process claims, conduct audits, and provide customer service. They are responsible for:

– Reviewing claims for accuracy and completeness

– Identifying potential fraud and abuse

– Issuing payments to providers

Understanding Medicare billing is vital for providers to avoid denials, delays, and potential legal implications. By following the established requirements and regulations, providers can ensure they are providing accurate and compliant claims, ultimately facilitating timely and appropriate reimbursement for healthcare services rendered to Medicare beneficiaries.

**Medicaid: A Lifeline for Healthcare Access**

In the realm of medical billing, Medicaid stands out as a beacon of hope for millions of low-income individuals. This federal-state partnership program plays a crucial role in making healthcare accessible and affordable for those in need.

Eligibility and Coverage

Medicaid provides comprehensive coverage for a wide range of medical services, including doctor visits, prescription medications, and hospital stays. Each state has its own eligibility requirements, based on factors such as income, family size, and disability status.

Billing Guidelines

Providers seeking reimbursement from Medicaid must adhere to specific billing guidelines. Claims must be submitted electronically through state-approved clearinghouses. Billing requirements vary by state, but generally include detailed documentation of services provided, patient demographics, and diagnosis codes.

State Administration

Medicaid is administered at the state level, with each state establishing its own policies and procedures. This decentralized approach allows for flexibility in tailoring coverage to the unique needs of different populations.

Benefits for Providers

Participating in Medicaid provides financial stability for providers. The program’s guaranteed reimbursement ensures that providers receive payment for covered services. Additionally, Medicaid simplifies billing procedures by consolidating multiple claims into a single payment system.

Challenges and Controversies

Medicaid is not without its challenges. Low reimbursement rates and administrative burdens can strain providers. Fraud and abuse remain ongoing concerns, leading to increased audits and oversight.

Despite these challenges, Medicaid remains a vital* program that provides healthcare access to millions of Americans. By understanding its _billing guidelines, providers can navigate the system effectively and ensure that their patients receive the medical care they need.

State Insurance Departments: Guardians of Health Insurance Regulation

As you navigate the labyrinth of medical billing, encountering various entities along the way, you may wonder: “Who oversees the complex web of health insurance and medical billing practices?” Enter the state insurance departments, the unsung heroes responsible for ensuring fairness and compliance in your corner of the healthcare system.

Within their respective states, these regulatory bodies wield the authority to enforce health insurance laws and regulations. They set the ground rules for medical billing practices, protecting both patients and providers from potential pitfalls. State insurance departments scrutinize insurance companies to ensure they adhere to billing guidelines and claims processing procedures. By holding insurers accountable, they protect patients from unfair denials or delays in healthcare coverage.

Their mandate extends to reviewing and approving health insurance plans offered by private carriers. They evaluate policies to ensure they meet minimum coverage requirements and are not misleading to consumers. By safeguarding the marketplace, state insurance departments cultivate a competitive environment that prioritizes fair pricing and transparency.

Whether you’re a medical professional or a patient, the presence of these vigilant watchdogs provides peace of mind. They serve as impartial arbiters, enforcing ethical billing practices and holding both insurers and providers accountable. Knowing that your state insurance department is there to protect your interests instills confidence in the medical billing process.

Patients: The Essential Participants in Medical Billing

As a patient, you play a pivotal role in the medical billing process. While you may often think of doctors and insurance companies as the driving forces behind it, your involvement is crucial.

Firstly, you provide essential demographic information that forms the cornerstone of your medical records. This includes your name, address, birth date, and social security number. Accuracy in this information ensures that your claims are correctly processed and payments are accurately directed.

Moreover, you are responsible for understanding and fulfilling your financial obligations related to medical services. This includes co-pays, deductibles, and any out-of-pocket expenses. By meeting these obligations, you help maintain the viability of the healthcare system and ensure the continued provision of high-quality medical care.

The Affordable Care Act, also known as Obamacare, has significantly expanded your rights as a patient in the medical billing process. This landmark legislation protects you from surprise medical bills, ensures your right to appeal claim denials, and prohibits discrimination based on pre-existing conditions.

Understanding your role in medical billing empowers you as a consumer of healthcare services. By providing accurate information, fulfilling financial obligations, and knowing your rights, you ensure a smooth billing process and safeguard your interests.

Core Entities in Medical Billing: Insurers

The world of medical billing involves a complex ecosystem of players, and insurers stand as crucial entities in this process. Their primary role revolves around paying for medical services, ensuring that healthcare providers receive compensation for the services they render.

Insurers can be broadly categorized into two main types:

Commercial Health Insurance Companies

These private entities provide health insurance coverage to individuals and groups, usually through employer-sponsored plans. They assess individuals’ or groups’ risk factors and determine premium payments based on these assessments. When a covered person seeks medical care, the insurance company reviews the claim and makes a payment to the provider as per the terms of the insurance policy.

Government Payers

Government-run health insurance programs, such as Medicare and Medicaid, play a significant role in providing coverage to specific population groups. Medicare caters to individuals aged 65 and over, while Medicaid serves low-income individuals and families. These programs have specific rules and regulations that providers must adhere to when billing for services.

Insurers act as critical stakeholders in the medical billing process, ensuring that providers receive timely payment for their services. Understanding the roles of commercial health insurance companies and government payers is essential for all participants in the healthcare industry.

Unveiling the Role of Third-Party Administrators (TPAs) in Medical Billing

In the intricate world of medical billing, TPAs emerge as invaluable partners for insurers, playing a pivotal role in the seamless processing of claims and payment administration. Their outsourcing services provide a lifeline for insurers, enabling them to navigate the complexities of medical billing and focus on delivering exceptional patient care.

Claims Processing: The Backbone of TPA Services

At the heart of TPA operations lies claims processing. TPAs expertly review claims submitted by healthcare providers, scrutinizing every detail to ensure compliance with insurer requirements. They verify patient eligibility, medical coding, and billing codes, identifying discrepancies and potential errors that could lead to claim denials or delays. Their meticulous attention to detail ensures accurate and timely processing, minimizing the burden on insurers and providers alike.

Payment Administration: Streamlining Financial Transactions

Beyond claims processing, TPAs also handle the intricate task of payment administration. They facilitate the secure and timely disbursement of payments to providers, ensuring that healthcare services are promptly reimbursed. This streamlined process reduces administrative costs for insurers and providers, freeing up resources for other critical operations.

Value-Added Services: Enhancing Efficiency and Compliance

In addition to their core functions, TPAs offer a range of value-added services that further enhance the medical billing process. They provide data analytics to insurers, identifying trends and patterns that can inform decision-making and improve billing accuracy. They also assist with compliance audits, ensuring that insurers adhere to regulatory requirements and minimize the risk of penalties or legal disputes.

Outsourcing Expertise: The Key to Operational Success

For insurers, outsourcing claims processing and payment administration to TPAs offers numerous benefits. It allows them to access specialized expertise and state-of-the-art technology, empowering them to:

- Improve Claim Processing Efficiency: Reduce turnaround times and eliminate bottlenecks in the billing cycle.

- Enhance Accuracy and Compliance: Minimize errors and ensure adherence to regulatory requirements.

- Free Up Internal Resources: Dedicate more time and effort to providing exceptional patient care.

- Control Costs: Reduce administrative expenses and allocate resources more effectively.

Third-party administrators (TPAs) are indispensable allies in the medical billing process, providing insurers with the expertise, resources, and support they need to operate efficiently and effectively. By leveraging their outsourcing services, insurers can streamline claims processing, enhance payment administration, and unlock value-added services that optimize their financial operations and elevate the quality of patient care.

Insurance Brokers: Navigating the Complexities of Medical Billing

In the intricate world of medical billing, insurance brokers play a crucial role, acting as guiding lights for individuals and businesses navigating the often-complex healthcare landscape. They serve as advocates, bridging the gap between patients, providers, and insurance companies.

Insurance brokers are knowledgeable professionals who possess an in-depth understanding of health insurance policies and regulations. They assist individuals and businesses in obtaining the optimal health insurance coverage that meets their specific needs and financial capabilities.

Once coverage is secured, insurance brokers continue to play a vital role in the billing process. They assist policyholders in understanding their insurance benefits, including coverage limits, deductibles, and co-payments. By demystifying the billing jargon, brokers provide clarity and help patients avoid unexpected medical expenses.

When it comes to submitting claims, insurance brokers can streamline the process. They ensure that claims are accurately prepared and submitted, minimizing the risk of denials or delays in payments. By acting as intermediaries between patients and providers, brokers facilitate smooth communication and resolve billing disputes in a timely and efficient manner.

Moreover, insurance brokers provide ongoing support to their clients, keeping them abreast of changes in insurance policies and regulations. They are valuable resources for patients seeking to maximize their coverage and navigate the complexities of medical billing with confidence.

Credentialing Organizations: Ensuring Provider Quality and Network Compliance

In the intricate world of medical billing, credentialing organizations play a pivotal role in safeguarding patient care and ensuring the integrity of healthcare networks. These independent entities serve as thorough gatekeepers, carefully scrutinizing the credentials of healthcare providers to verify their qualifications and ensure they meet the rigorous standards set by insurance companies and healthcare organizations.

Through a comprehensive process known as provider credentialing, these organizations meticulously examine a provider’s education, training, experience, and licenses to confirm their competence in delivering high-quality patient care. They also verify that providers are in good standing with state medical boards and have no history of malpractice claims or disciplinary actions.

This rigorous vetting process serves several critical purposes. It helps ensure that only qualified and experienced providers are included in insurance networks, giving patients peace of mind knowing they are receiving care from reputable practitioners. Furthermore, it protects insurance companies from financial liabilities associated with unqualified providers and safeguards the reputation of healthcare organizations by maintaining a high standard of provider quality.

Credentialing organizations also play a vital role in ensuring that providers meet the specific requirements of insurance networks. They verify that providers have the necessary training and certifications to provide specific services and that they are up-to-date on the latest medical advances. This helps ensure that patients have access to the most comprehensive and effective healthcare services available.

By partnering with credentialing organizations, healthcare providers can streamline the application process, gain recognition within insurance networks, and demonstrate their commitment to delivering exceptional patient care. Insurance companies and healthcare organizations, in turn, benefit from the assurance that their networks comprise only qualified and credentialed providers, mitigating risks and enhancing the quality of care for their patients.

Auditors: Guardians of Medical Billing Integrity

In the intricate tapestry of medical billing, auditors play a pivotal role, akin to vigilant detectives ensuring compliance and accuracy. Their keen eyes scan through mountains of claims, seeking out potential errors that can jeopardize patient care and financial stability.

Conducted regularly, audits are thorough examinations of billing records, designed to verify the proper billing of medical services. These reviews ensure that healthcare providers adhere to established regulations and guidelines, safeguarding both patients and payers from fraudulent or overcharging practices.

Auditors meticulously analyze claims for discrepancies, such as incorrect coding, duplicate billing, or unsupported documentation. By identifying these anomalies, they help providers rectify billing errors promptly, preventing costly penalties or legal issues down the road.

Sub-headings

- Protecting Patient Rights: Audits ensure that patients receive the care they need without being overcharged or subjected to fraudulent practices.

- Safeguarding Financial Integrity: Hospitals and insurance companies rely on accurate billing to maintain financial stability and provide quality healthcare services.

- Promoting Transparency: Audits foster trust and transparency within the medical billing system, reducing instances of fraud and ensuring proper use of healthcare funds.

Call to Action:

If you suspect any irregularities in your medical bills, do not hesitate to seek professional advice. Auditors can provide valuable insights that can protect your rights and ensure that you are receiving fair and accurate healthcare services.

Attorneys: The Legal Navigators of Medical Billing Disputes

In the complex world of medical billing, legal disputes can arise between providers, payers, and patients. Enter attorneys, the legal navigators who guide these parties through the labyrinthine legal landscape.

Attorneys play a pivotal role in representing providers, defending their claims and ensuring fair payment for services rendered. They advocate for timely and accurate reimbursements, safeguarding the financial well-being of healthcare practitioners. When claim denials or other billing disputes arise, attorneys diligently investigate and present compelling arguments in pursuit of a favorable resolution.

Similarly, payers also retain attorneys to protect their interests. Attorneys representing payers review claims for accuracy, identify potential fraud, and defend against improper charges. Their expertise ensures that resources are allocated fairly and appropriately.

Attorneys are not only present in adversarial proceedings but also in collaborative settings. They help negotiate settlements, draft contracts, and advise clients on compliance with regulatory requirements. Attorneys strive to craft solutions that balance the interests of all parties and promote a fair and equitable billing system.

In cases of alleged fraud, attorneys play a crucial role in investigating allegations, identifying liable parties, and pursuing legal remedies. Their diligence protects the integrity of the healthcare system and safeguards patients from unethical practices.

Ultimately, attorneys provide an essential layer of protection and guidance in the often-contentious realm of medical billing disputes. Their expertise empowers providers, payers, and patients to navigate legal challenges and achieve fair outcomes.