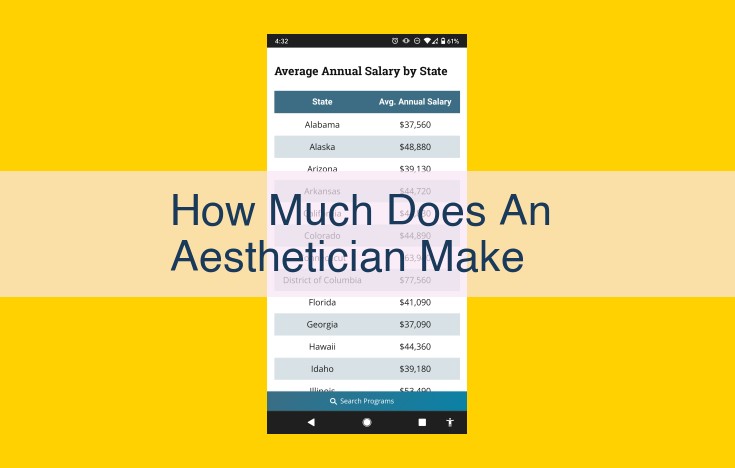

Aestheticians’ income varies widely based on factors such as experience, location, and type of services offered. According to the Bureau of Labor Statistics (BLS), the median annual salary for aestheticians and skincare specialists was $35,350 in May 2022. The lowest 10 percent earned less than $22,400, and the highest 10 percent earned more than $62,360. In addition to their base salary, aestheticians may also earn tips, commissions, and bonuses. The BLS projects a 19% job growth for aestheticians from 2021 to 2031, which is much faster than the average for all occupations.

Income and Salary: The Cornerstone of Financial Stability

Financial stability is the bedrock upon which our dreams and aspirations are built. At the core of this stability lies income and salary. They are the lifeblood that fuels our essential expenses, grants us access to opportunities, and enables us to achieve our long-term financial goals.

Income: The Fuel for Financial Obligations

Our income constitutes the foundation upon which we meet our financial obligations. It is the means by which we pay our mortgages, rent, utilities, groceries, and other essential living costs. Without a steady source of income, these essential expenses would remain unmet, leaving us in a state of financial vulnerability.

Salary: The Pathway to Financial Goals

Beyond meeting our essential needs, income also serves as the pathway to achieving our financial dreams. Whether it be saving for retirement, purchasing a home, or investing for the future, a stable salary is the first step towards realizing these aspirations. It provides us with the financial freedom and flexibility to pursue our passions and live the life we envision.

Sources of Income: Diversifying Your Financial Streams

Employment: The traditional source of income, employment offers stability and a regular paycheck. However, relying solely on employment can expose us to potential job loss or market fluctuations.

Self-Employment: For those with entrepreneurial spirits, self-employment offers the opportunity to control their income and schedule. However, it also comes with its own set of challenges, such as managing business expenses and securing a steady stream of clients.

Investments: Investments, such as stocks, bonds, and real estate, can provide additional sources of income. However, it is important to note that investments carry varying levels of risk and may fluctuate in value.

Diversify Your Income Streams: Reducing Financial Risk

In today’s rapidly changing economy, it is more important than ever to diversify our income streams. By doing so, we reduce our reliance on any single source and minimize our exposure to potential financial setbacks. A diverse income portfolio provides us with a greater sense of financial security and resilience.

Job Market and Employment: Shaping Income Earning Potential

In the competitive landscape of today’s job market, navigating the relationship between employment and income earning potential is crucial for financial stability and success. The interplay of job availability, competition, and industry trends has a profound impact on the opportunities and salaries that shape our financial trajectories.

Job Availability: The Pulse of Employment

The availability of jobs is a primary determinant of income earning potential. Times of economic growth and expansion typically lead to a surge in job creation, increasing the number of open positions and driving up wages. Conversely, recessions and economic downturns can result in job losses and reduced opportunities, leading to lower salaries.

Competition: The Battle for Jobs

The level of competition in a particular industry also shapes income earning potential. Some fields, such as technology and finance, have historically high levels of competition, which can drive down salaries as employers have a wide pool of qualified candidates to choose from. On the other hand, industries with a shortage of skilled workers may offer higher salaries to attract and retain talent.

Industry Trends: The Changing Landscape

Industry trends can significantly influence job opportunities and salaries. Emerging technologies, shifts in consumer preferences, and globalization can create new job roles or render others obsolete. Understanding these trends and adapting to the changing landscape is essential for maximizing income earning potential.

Upskilling: The Key to Adapting

In an ever-evolving job market, upskilling and lifelong learning are vital for staying competitive and enhancing income earning potential. Acquiring new skills, enhancing knowledge, and specializing in in-demand areas can open doors to better-paying roles and promotions.

Bridging the Gap

Navigating the complex relationship between the job market and income earning potential requires a strategic approach. By staying informed about job market trends, exploring alternative income streams, and investing in upskilling, individuals can bridge the gap between job availability, competition, and their desired income goals.

Exploring Alternative Income Streams: Diversifying Your Financial Portfolio

Maintaining a single stream of income can leave you vulnerable to financial instability during unexpected events or economic downturns. Diversifying your revenue sources is crucial for mitigating risks and securing your financial well-being.

Benefits of Diversifying Income Streams:

- Reduced Financial Risk: By tapping into multiple sources of income, you lessen the impact of fluctuations or disruptions in any one revenue stream.

- Increased Financial Stability: Alternative income streams can supplement your primary income, providing a safety net during job loss or other unforeseen circumstances.

- Expanded Cash Flow: Additional revenue sources can significantly increase your cash flow, allowing you to meet financial obligations with greater ease.

Alternative Income Sources to Explore:

- Passive Income: Generate income without actively working, such as through investments, rental properties, or licensing intellectual property.

- Side Hustles: Engage in part-time work or freelance activities alongside your primary job to supplement your income.

- Entrepreneurship: Start your own business to create a new income stream and gain potential for significant growth.

Diversifying your income streams requires thorough planning and research. Explore different options and choose those that align with your skills, interests, and financial goals. Consider the time commitment, start-up costs, and potential return on investment for each option.

Remember, building a diversified financial portfolio takes time and effort. By exploring alternative income sources, you can expand your earning potential, increase your financial stability, and secure your financial future.

**Financial Planning for Income Stability: Managing Fluctuations**

Maintaining a steady income is crucial for financial stability, but life often throws us unexpected income fluctuations. Whether it’s a job loss, a medical emergency, or a seasonal dip in sales, it’s essential to be prepared for when our income takes a hit. Financial planning can serve as an anchor during these turbulent times, providing a roadmap to navigate income fluctuations and secure our financial well-being.

**Managing Expenses**

The first step in financial planning is to get a clear picture of our expenses. This involves tracking all our fixed (regular) expenses, such as rent, utilities, and car payments, as well as variable (fluctuating) expenses, like groceries, entertainment, and dining out. Once we know where our money is going, we can identify areas where we can cut back or find ways to save.

**Creating a Budget**

A budget is a powerful tool for managing income fluctuations. By allocating each dollar we earn to specific categories, we can ensure that our essential expenses are covered and we have funds set aside for savings and unexpected costs. Sticking to our budget requires discipline, but it’s a vital step towards financial stability.

**Saving for the Unexpected**

Emergencies happen, and having a savings fund can prevent us from going into debt or sacrificing our financial goals. It’s recommended to set aside at least 3-6 months’ worth of living expenses in an emergency fund. Once we have an emergency fund in place, we can focus on other savings goals, such as retirement or a down payment on a house.

By following these financial planning strategies, we can prepare for income fluctuations and protect our financial well-being. It’s not always easy to stick to a budget or save for the unexpected, but the peace of mind and financial security we gain in the long run is well worth the effort.

Upskilling and Adapting to the Changing Labor Market

In today’s rapidly evolving job landscape, upskilling and adapting have become essential for maintaining gainful employment and financial well-being. The rise of technology, globalization, and automation is transforming industries, creating both new opportunities and challenges for workers. To thrive in this dynamic environment, individuals must continuously enhance their skills and embrace lifelong learning.

One effective approach to upskilling is to identify emerging trends in the industry and acquire relevant knowledge and certifications. This may involve taking online courses, attending workshops, or pursuing a graduate degree. Networking with professionals in your field and attending industry events can also provide valuable insights into the skills and competencies that employers are seeking.

Adapting to the changing labor market requires a mindset of flexibility and resilience. Workers should be open to exploring new roles and responsibilities within their current organization or seeking opportunities in different industries. Embracing remote work and gig economy models can also provide greater work flexibility and income diversification.

Continuous learning should not be limited to technical skills. Developing soft skills, such as communication, problem-solving, and teamwork, is equally important. These skills are highly valued by employers and can make individuals more adaptable to various work environments.

Investing in upskilling and adapting to the changing labor market is an ongoing process that requires dedication and commitment. By embracing these strategies, individuals can enhance their employability, increase their earning potential, and navigate the future of work with confidence.

Navigating the Interplay of Income and Employment

In the tapestry of our financial lives, income and employment are inextricably intertwined. Our income serves as the lifeblood of our financial stability, enabling us to meet our obligations and pursue our goals. Employment, in turn, is the primary source of income for most of us. Understanding the symbiotic nature of income and employment is crucial for navigating the complexities of the job market and maximizing our financial well-being.

Job Market Dynamics and Income Potential

The job market is a constantly evolving landscape, influenced by a myriad of factors. Economic conditions, industry trends, and technological advancements all shape job availability. High demand for skilled professionals in a growing industry can lead to increased salaries and better benefits. Conversely, a shrinking job market can result in lower wages and reduced employment opportunities. Understanding these market dynamics is essential for assessing our income earning potential and making informed career decisions.

The Impact of Economic Conditions

Economic conditions have a profound impact on both income and employment. A strong economy with low unemployment rates typically leads to higher wages and more job opportunities. Conversely, economic downturns often result in lower incomes and layoffs. Being aware of economic trends and their potential impact can help us plan for financial fluctuations and mitigate risks.